Insider Survey: Sites Cope with Rising Operating Costs

Over the past two years, balancing operating budgets has become more of a juggling act for site owners and managers at low-income housing tax credit (LIHTC) sites. And the recent recession coupled with the loss of jobs among residents have not helped. As the cost of doing business increases, a majority of site owners and managers find themselves taking a slice out of one cost area to make up for the lack of funds in another or trying to come up with other ways to save money.

Approximately 62 percent of respondents to a recent Insider survey said they are finding it more difficult to budget and manage their sites' overhead costs compared to a year—or even two years—ago. Reasons cited range from the decline in the number of tax credit-eligible families to property expense rate increases. Some respondents commented that their cities are targeting LIHTC sites for additional revenues to fill their own coffers, and charging higher—or tacking on new—fees for administrative services, such as housing inspections.

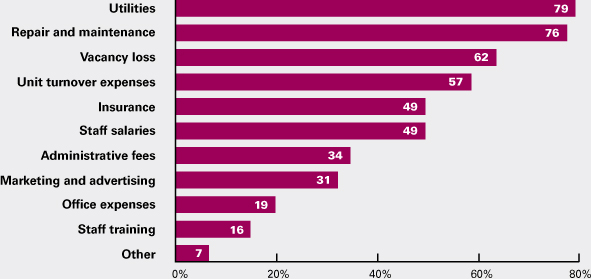

LIHTC site owners and managers have seen their operating costs rise in the past 12 months in a number of areas, and report paying more for: utilities (electricity, gas, water, and sewer), 79 percent of respondents; repair and maintenance, 76 percent; vacancy loss, 62 percent; unit turnover expenses, 57 percent; and insurance and staff salaries, 49 percent each (see Figure 1).

The biggest concern of those surveyed is finding acceptable households to fill their LIHTC units. One respondent noted that many prospects in his area can now afford to pay the lower market-rate rents, which are on a par with LIHTC units. In contrast, another respondent commented that many residents just are unable to pay lower affordable housing site rents and, as a result, will need to vacate their units.

For the 38 percent who are managing to keep their operating budgets in line, they are taking strict measures such as freezing staff salaries, focusing on resident retention, delaying certain improvements, or doing their own maintenance work. Several respondents say they have stepped up preventive maintenance at their LIHTC sites. Several site managers are “spreading” their maintenance personnel around multiple sites, while others are getting additional bids for regularly contracted work, in anticipation that they can find contractors that charge less.

Vacancy Loss Taking a Toll on Budgets

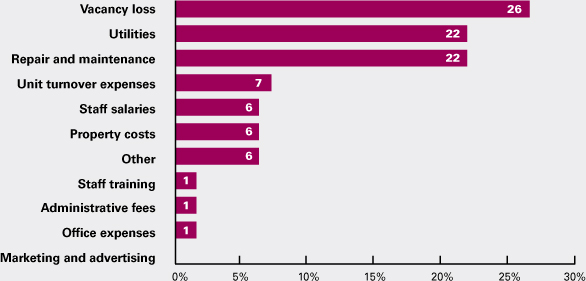

When asked to identify which operating costs have increased the most over the past 12 months, vacancy loss was the number-one item (26 percent) the respondents chose. Utilities and repair and maintenance were tied for second place at 22 percent each (see Figure 2).

Commenting on the effects of vacancy loss on LIHTC sites, one respondent said that “vacancies have fluctuated greatly” at his site over the past two years. Another has witnessed an increase in the number of families moving in together to save on rent. Another survey respondent said his site is losing seniors, who can no longer live independently, making it more difficult to fill vacant units.

Based on the survey responses, it is easy to conclude that raising or lowering rents will not solve the problem of filling vacant LIHTC units. One respondent said that his site was not getting the number of applicants who had the interest or ability to pay the LIHTC rent, “especially when they already are having problems making ends meet.” Another respondent added that more residents are vacating because they cannot even manage to pay the low LIHTC rents. As one site manager bluntly stated: “People cannot afford T[ax] C[redit] rents and owners cannot afford to keep reducing rents to fill units.”

In all areas of the country, owners are feeling the effect of market rents that are closely competitive with LIHTC rents. One owner commented that in his area: “Market rents are very close, if not below, 60 percent LIHTC rents (sometimes even 50 percent rents), resulting in more marketing costs, higher unit turnover and related costs, and increased financial vacancy loss.”

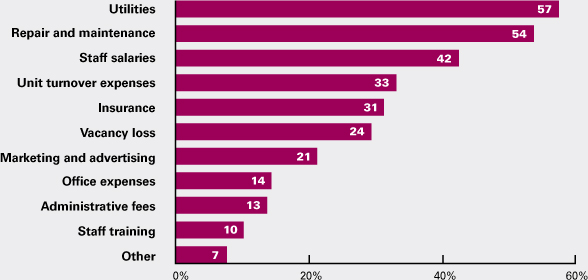

When asked to project those areas in which they expect operating costs to increase within the next 12 months, utilities (57 percent), repair and maintenance (54 percent), staff salaries (42 percent), unit turnover expenses (33 percent), and property insurance (31 percent) topped the list (see Figure 3).

Operating Budgets Tight, But Realistic

Although funds may be tight, most LIHTC site owners and managers are confident that their budgets are realistic and they will be able to manage their overhead costs effectively (68 percent).

Operating Costs That Increased During 2009-2010

Where Operating Costs Increased the Most

Operating Costs Expected to Increase Within Next 12 Months

Survey respondents who had a different opinion gave several reasons why:

-

“Costs are increasing beyond anticipation and control in today's economy.”

-

“There are too many ongoing maintenance issues that have increased our costs over the last 12 months and will continue. Additionally, the cost of utilities—included in the rent—has become ridiculous.”

-

“Revenue expectations are too high.”

For owners and managers who walk a fine line, the majority (53 percent) are cutting operating costs in one area so they can make up for the lack of funds in another. Maintenance and amenities have been the hardest hit. For example, one site manager transferred dollars from repairs and maintenance to make up for his utilities budget shortfalls. Others have cut back on landscaping services (for example, by mowing lawns every 10 days instead of weekly) or delayed hiring additional janitorial and maintenance staff. One respondent reports “cutting back everywhere, except advertising, to make up for the increase in vacancy loss.”

The good news for LIHTC site owners and managers is that the majority (92 percent) who participated in this survey say their sites' expenses have not been questioned or rejected by their local housing authority during their last two annual reviews.

Biggest Challenges: Finding Eligible Residents, Keeping Up Appearances

Even in this economic climate, which has forced many homeowners into foreclosure and increased the pool of potential renters, finding eligible residents for LIHTC sites is still problematic and is probably the biggest management challenge for site owners and managers. A number of survey participants are finding it hard working within the confines of tax credit rent.

One respondent said that it is hard “losing prospects to conventional communities that have more amenities for the same rent.” Another respondent agreed, adding: “It is hard filling vacancies in a market where seniors on fixed incomes cannot afford the rates in a tax-credit/non-Section 8 environment, especially when subsidized units offer the same amenities.” One site manager, who is having a tough time “competing with market-rate rents, especially for our 60 percent units,” has opted to lower rents or offer discounts and incentives, which has increased turnover costs and decreased income.

Although some sites are not having problems finding residents, keeping them may be iffy. Several site managers report that a growing number of residents, who initially qualified for tax credit units and were able to pay their rent on time, have lost their jobs and now cannot even afford to make their monthly payments. Some are just “skipping out”; others are being evicted. And many of them are leaving their units in poor condition—adding more costs to hard-pressed site operating budgets.

Other big challenges to managing operating costs include keeping the property in “excellent condition” to attract prospective residents and prevent potentially large, costly capital expenses, followed by keeping up with utility costs (such as rising water usage rates), maintaining qualified staff, and paying rising insurance costs.

Balancing Act

Despite the data indicating that supporting construction and preservation of affordable housing—particularly housing financed by low-income tax credits—has a broad, positive effect that generates a significant return on investment,* affordable housing continues to be a major concern and challenge across the nation, especially for low-income renters.

The effectiveness of LIHTC housing was severely hampered by the economic downturn in 2008 and 2009, U.S. Senator Maria Cantwell said last year when calling for a one-year extension of the Low-Income Housing Tax Credit Exchange. And this trend continued through 2010 as LIHTC site owners and managers struggle to manage their operating costs and balance their budgets.

As one site owner noted: “It is hard to control costs in an environment that is not stable.” Owners and managers will need to come up with new and inexpensive ways to attract and retain qualified residents who can keep up with their monthly rent payments. By the same token, they will be unable to attract prospective residents if they cannot compete by offering well-maintained units or amenities on a par with fair market rentals.

* Local Initiatives Support Corporation and Enterprise Community Partners (2010), Affordable housing for families and neighborhoods: The value of low-income housing tax credits in New York City. Retrieved July 12, 2010, from www.lisc.org/content/publications/detail/18450.

Sidebar

Survey Respondents' Profile

The Insider conducted an online survey of tax credit housing professionals who subscribe to our online publication and e-newsletter. Within the group of respondents, 39 percent were management company executives, 18 percent were property owner financial executives, 18 percent were site managers, 10 percent were property owner managing directors or executives, and 15 percent were “other.” The LIHTC sites they represent range from more than 10 buildings (33 percent) to one building (22 percent). The majority of the sites also receive Section 8 funds (54 percent). Approximately 32 percent receive HOME funds, while 21 percent do not receive any additional funding. The majority of the respondents' sites are located in the Midwest (29 percent), closely followed by the Northeast (28 percent). The Southwest was represented by 12 percent of the respondents.

Search Our Web Site by Key Words: management basics; budgeting; cost control