Insider's 2012 Survey Results: Tackling the Top Compliance and Management Challenges

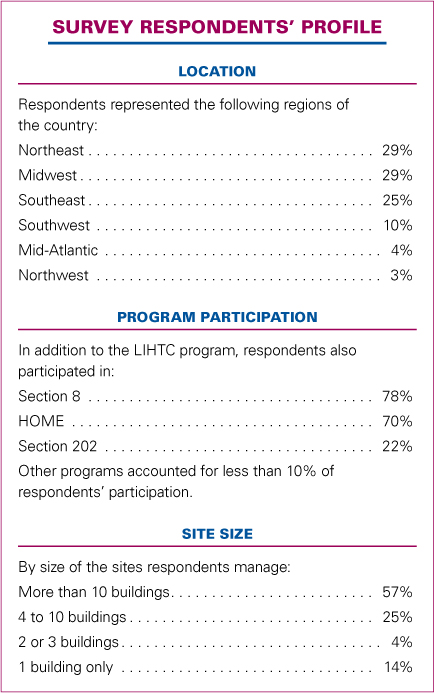

In today's economy, providing affordable housing to low-income families is more important than ever. There may be plenty of applicants, but there are also considerable challenges in verifying that they're qualified for the LIHTC program and in keeping up with rising operational costs. Last month, the Insider conducted a survey of tax credit site managers across the country to find out about these and other challenges they're currently facing.

The challenges begin at the application process: Getting applications approved quickly is an issue for 43 percent of survey respondents. Almost all respondents put the blame for this on third parties who don't return verifications in a timely manner. “Places want to charge to fill out verification forms,” said one respondent. Verification of child support is particularly difficult, said another.

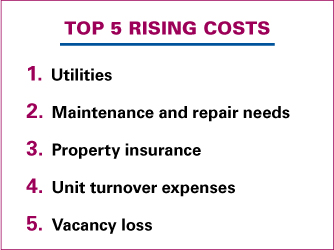

The delay in getting applications approved may contribute to vacancy loss, which, along with unit turnover costs, were among the top five rising costs cited by respondents. Utilities, maintenance/repairs, and insurance topped the list of rising costs.

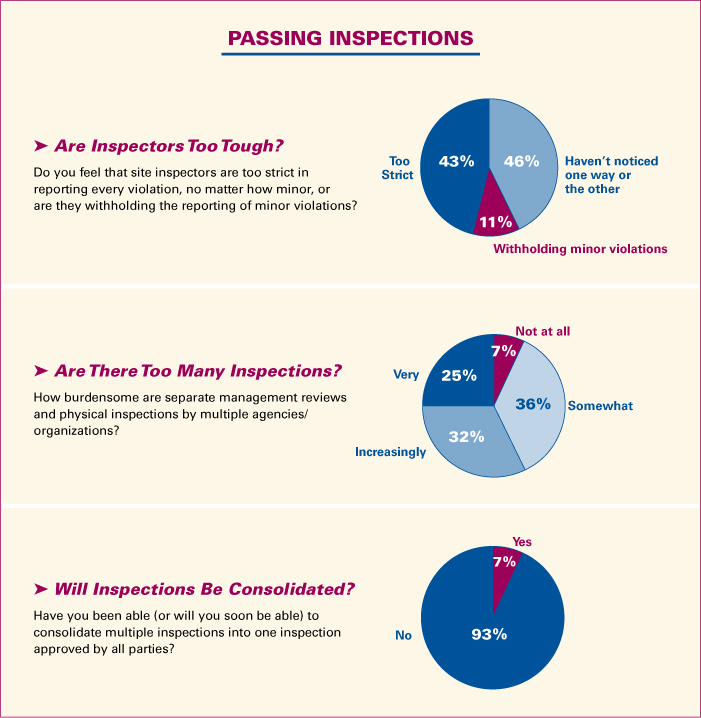

Most respondents manage mixed-program sites, with 70 percent or more receiving Section 8 and/or HOME funds. These respondents expressed frustration with: keeping up with all the changing rules; going through “too many inspections”; figuring out how to proceed when two agencies have conflicting regulations (several cited complying with the student rule); setting up files for multiple reporting agencies; and dealing with cumbersome annual reports and the file review process. One respondent put it simply: “The paperwork is tremendous.”

In light of these compliance challenges, it may be surprising that less than a third (29 percent) of respondents use consultants for compliance oversight. The tasks consultants are mainly hired for are annual audits, first-year audits, and application approval reviews before move-in.

With tax credits being used to finance the lion's share of the multifamily development, acquisition, and rehabilitation projects these days, it's no surprise that 36 percent of respondents were involved in a tax credit-financed acquisition or rehab in the past two years. Some of the major issues these respondents encountered during rent-up included: overcoming the previous property's image; dealing with a poor-quality rehab where work still had to be completed or repaired after move-in; and getting qualified tenants when most applicants were over-income.

Roughly one-third (32 percent) of respondents manage sites that are in the extended-use period. But few reported compliance challenges that are any different from compliance during the first 15 years—in fact, several respondents reported having fewer inspections and less stringent state oversight on compliance.

Based on these survey results, the Insider will plan future articles addressing the challenges raised here. In the meantime, please search our Web site, www.taxcredithousinginsider.com, for recent articles on these topics, such as:

-

How to Handle Verification When Source Doesn't Return Form

-

Five Compliance Differences Between Managing Mixed-Income and 100% Buildings

-

How to Avoid Common Mistakes When Calculating Annual Income

-

How to Keep Track of Over-Income Households to Comply with NAU Rule

-

How to Hire Qualified Employees to Manage Your Tax Credit Site